Viral TikTok trend 'cash stuffing' could help Gen Z stick to a budget

NEW YORK - Gen Z is apparently taking it old school when it comes to the Benjamins, and the trend is all over TikTok.

What is ‘cash stuffing’?

Using "cash stuffing" or "the envelope method", people take their income for the month minus expenses, then divide the cash into envelopes with different categories – only spending what's in each envelope.

Any leftover cash goes straight into savings.

"I think it's good that Gen Z is starting to think about budgeting and taking some financial responsibility," financial advisor Bryan Kuderna, who's the author of What Should I Do With My Money, said. "I also think in reality, it's a symptom of the fact that Gen Z, remember right now is about 10-years-old to 24-years-old.

Kuderna continued to say: "So it's a very small segment that's actually even eligible for a credit card. You've got to be 18 to get a credit card and since the Credit Card Act of 2009, it's very difficult under the age of 21 to get a credit card. So, I think of 18 to 21 years old/college age are thinking about their money, how to be smart about it."

Kuderna adds the method is a sound start for young people.

"The cash stuffing idea, I know you see it on TikTok and stuff, I think it's almost a good practice or a good exercise and then hopefully in a few years when that 22-year-old is 25, now they say, 'OK, I'll take that same strategy, but I can get myself a month's time with my credit card. I can build my credit history, get a couple of points along the way,' and then they can make it kind of a win-win," Kuderna said.

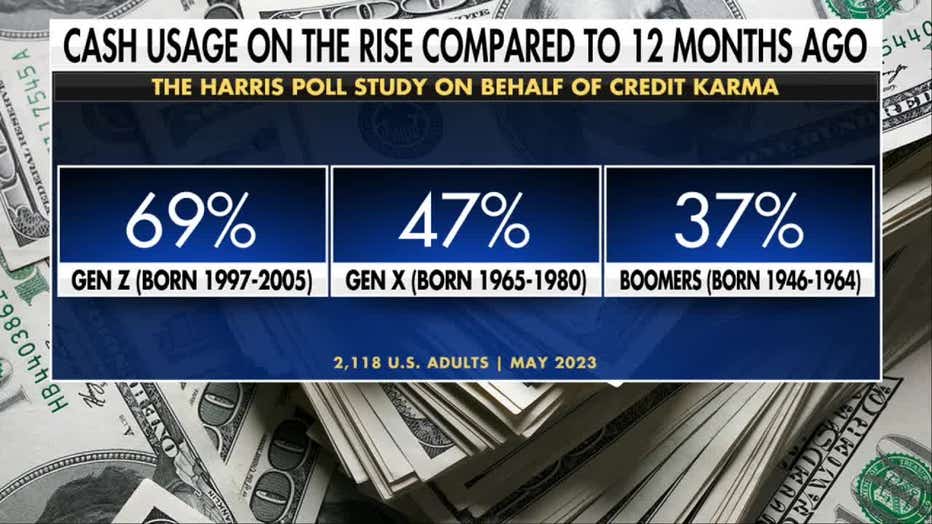

According to a recent Credit Karma Report, almost 70% of Gen Z is using cash more now than they did 12 months ago – more than Gen X (47%) and Baby Boomers (37%).

As for budgeting, New Yorkers FOX 5 NY spoke to used various methods, including apps such as Mint, words docs and the 50/30/20 method – 50 toward savings, 30 toward wants and 20 toward spending.