Americans doubtful that Biden will deliver student loan forgiveness in 2022, poll shows

A new poll shows that U.S. adults believe President Joe Biden will make little progress in canceling debt for student loan borrowers in 2022. (iStock)

As a presidential candidate, Joe Biden advocated for canceling $10,000 worth of federal student loan debt per borrower. But voters express little confidence that the president will deliver on this campaign promise in 2022, according to a January poll conducted by The Economist and YouGov.

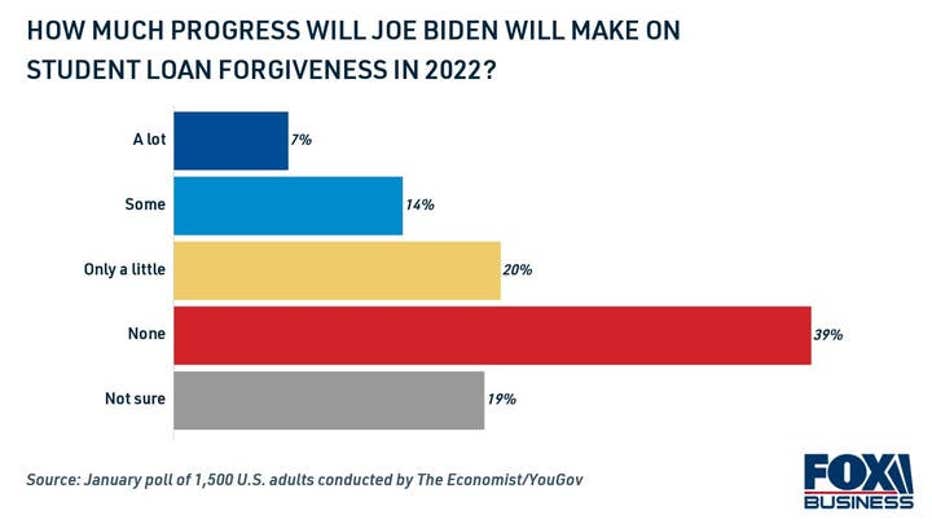

While 21% of U.S. adults said that Biden will make "some" or "a lot" of progress in delivering student loan forgiveness this year, the vast majority (59%) believe he will make little or no headway in canceling student debt.

The new data is released as Democrats are ramping up pressure on the president to deliver on his campaign promise of canceling student debt ahead of the midterm elections.

Keep reading about the likelihood of student loan forgiveness in 2022, including which borrowers have qualified for debt relief under the Biden administration. If you have loans that don't qualify for debt cancellation, such as private student loans, consider refinancing for better terms. You can compare student loan refinance rates on Credible for free without impacting your credit score.

BIDEN HAS CANCELLED $5B IN STUDENT LOANS UNDER PUBLIC SERVICE LOAN FORGIVENESS PROGRAM

More Americans support student loan forgiveness than oppose it

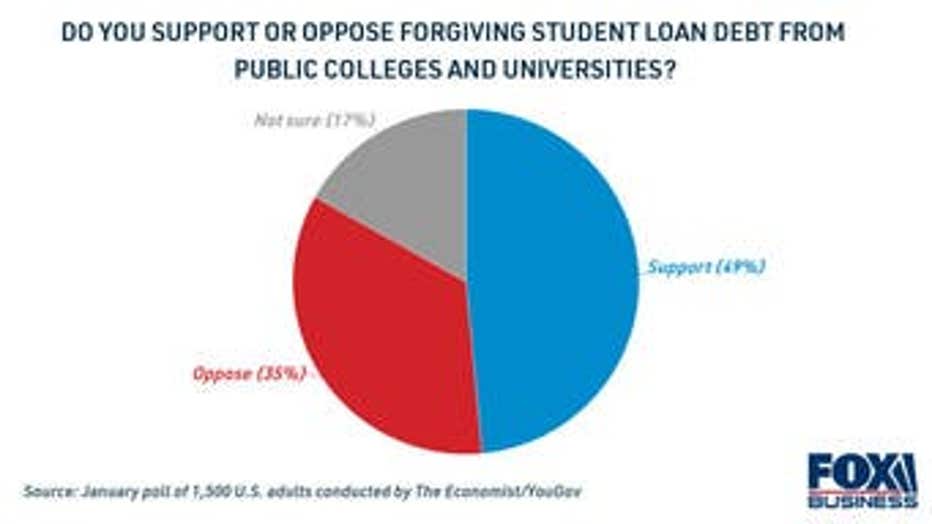

Student loan debt is a burden that weighs heavily on millions of borrowers who are eager to have their loan balances wiped clean. Widespread student loan forgiveness is popular among Americans, the poll shows, with nearly half (49%) supporting it and about a third (35%) in opposition.

WHAT TO DO IF YOUR STUDENT LOAN SERVICER IS SHUTTING DOWN

However, student debt forgiveness is a partisan issue that's split along party lines. About 70% of Democrats support forgiving student loan debt from public colleges and universities, while just 25% of Republicans said the same.

This divide has made it difficult for President Biden to cancel student loans. While some progressives have urged the president to forgive student loan debt using executive action, the White House has previously indicated that Biden is waiting on Congress to enact student loan forgiveness legislation.

Since Congress has been unable to deliver on other parts of Biden's agenda, including the Build Back Better spending bill, it would be difficult for lawmakers to pass student loan cancellation measures. Democrats hold a razor-thin 50-50 majority in the Senate, and it's unknown if more moderate Democrats would vote in favor of forgiving student debt.

With the future of broad student loan forgiveness uncertain, some borrowers may be considering refinancing to a private loan at a lower interest rate. You can learn more about student loan refinancing and compare current interest rates across private lenders on Credible.

CORONAVIRUS STUDENT LOAN INTEREST WAIVERS BEING OFFERED

675K borrowers had student loans forgiven, but broad relief is yet to come

Since Biden took office, the Department of Education has extended nearly $15 billion worth of debt relief to about 675,000 borrowers through existing student loan forgiveness programs. Here's who has qualified for debt cancellation under the Biden administration:

- Total and permanent disability discharge (TPD). In August 2021, the Education Department announced that eligible borrowers would automatically qualify for a TPD discharge through existing data provided by the Social Security Administration (SSA). As a result, more than 400,000 borrowers with a total and permanent disability had $7 billion worth of federal student loans forgiven.

- Public Service Loan Forgiveness (PSLF). Under this federal student loan repayment program, eligible full-time public servants can have the remaining balance of their Direct loans discharged after making 120 consecutive qualifying payments. The Biden administration overhauled this program in October 2021, which resulted in 70,000 borrowers receiving $5 billion worth of relief in 2021.

- Borrower defense to repayment. About 92,000 borrowers who were misled by a school involved in misconduct qualified for $1.5 billion under the borrower defense program. This includes borrowers who attended the Court Reporting Institute, ITT Technical Institute, Marinello Schools of Beauty and Westwood College.

- Closed school discharge. Another 115,000 ITT Tech students received $1.26 billion worth of student loan relief under the closed school discharge program. This round of loan discharges was granted to borrowers who left the now-defunct institution on or after March 31, 2008, without completing their degree.

WHAT ARE THE FEDERAL DIRECT LOAN LIMITS FOR THE 2021-22 SCHOOL YEAR?

Although many borrowers have qualified for student debt relief, millions more still owe an outstanding student loan balance of $1.75 trillion, according to the Federal Reserve. It's unclear whether Biden will deliver the widespread debt forgiveness he campaigned on, which means that some borrowers may be looking for alternative student loan repayment options.

One such method is refinancing to a private student loan at a lower interest rate. Student loan refinancing can help you reduce your monthly payments, pay off debt faster and save money on interest charges over time. But refinancing your federal student loan debt into a private loan will make you ineligible for select student loan forgiveness programs, income-driven repayment plans (IDR) and the current COVID-19 emergency forbearance period, which expires this May.

If you don't plan on utilizing these benefits — or if you already have private student loans that don't qualify for federal protections — then it may be worthwhile to refinance your student loan debt. Use Credible's student loan refinance calculator to determine if this debt repayment strategy is right for your circumstances.

YOU COULD SEE A LOWER IRS TAX REFUND THIS YEAR, AND THIS IS WHY

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.